Business Insurance in and around Las Vegas

One of Las Vegas’s top choices for small business insurance.

Helping insure small businesses since 1935

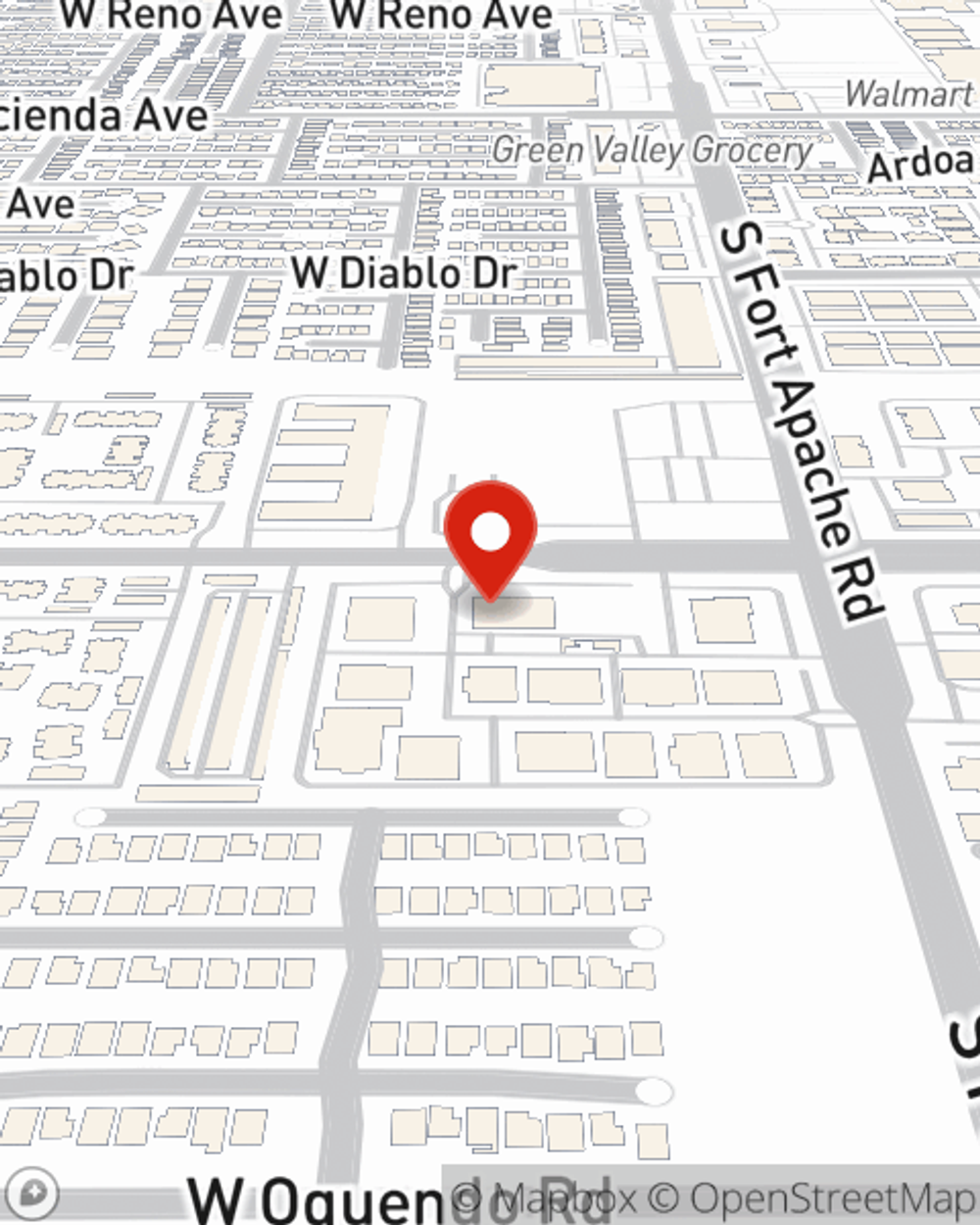

- N Las Vegas

- Las Vegas

- Oregon

- California

- Utah

- Orange County

- Nevada

- Los Angeles

- Summerlin

- San Diego

- Bay Area

- San Francisco

- Reno

- Portland

- Henderson

Business Insurance At A Great Value!

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or damage. And you also want to care for any staff and customers who hurt themselves on your property.

One of Las Vegas’s top choices for small business insurance.

Helping insure small businesses since 1935

Protect Your Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict natural disasters or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like a surety or fidelity bond and extra liability. Terrific coverage like this is why Las Vegas business owners choose State Farm insurance. State Farm agent Mike Whitford can help design a policy for the level of coverage you have in mind. If troubles find you, Mike Whitford can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by calling or emailing State Farm agent Mike Whitford today to explore your business insurance options!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Mike Whitford

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.